Contributed by CDSPI

If you’ve taken out a mortgage to purchase your home, your lender likely asked whether you wanted to purchase mortgage insurance. It makes sense to want to protect one of the biggest investments you are likely to make — particularly if you plan to live and raise a family in it.

Ensuring your loved ones can keep your family home if something unforeseen happens to you should be a top priority.

However, the type of mortgage insurance your lender may have offered (commonly called “creditor insurance”) might not be the best option for your situation. Indeed, life insurance offers options and benefits that may better fit your financial priorities.

Mortgage insurance vs. life insurance

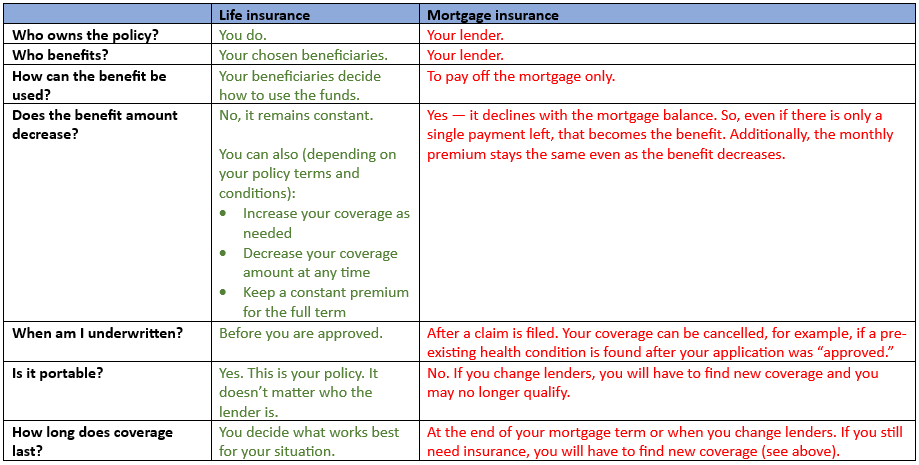

Let’s take a step back and examine what these products do and how they compare. Mortgage insurance and life insurance have a similar purpose (i.e. ensuring your family can continue to live in their home if something happens to you), but they have a few key differences.

The death benefit on mortgage insurance only covers the outstanding mortgage amount and is paid directly to the lender, whereas life insurance pays the death benefit to the beneficiaries named in the policy, who can then apply this money towards the mortgage or anything else. This can be helpful, as your loved ones may prefer to use these funds to cover other expenses, such as funeral costs, childcare, other living expenses, or academic/business pursuits. Personal life insurance gives beneficiaries the flexibility to choose what works best for them.

Knowing you’ve got it covered

These types of insurance also differ when it comes to determining if you qualify for coverage and if the claim will ultimately be paid.

With mortgage insurance, it is usually determined if you qualify for the coverage after your beneficiaries submit a claim. Even though you answer many questions when you apply for a policy, if a pre-existing health condition is found, a claim may be denied. This is called “post-claim” (or “post-death”) underwriting, and its potential consequences are not the kind of legacy you want to leave behind.

“With life insurance, all the underwriting is completed before your insurance goes into effect,” says Julie Berthiaume, a senior insurance advisor at CDSPI Advisory Services. “You may be asked to complete a health questionnaire or take medical tests, but you can be confident that your beneficiaries won’t be left in the cold when they need to make a claim.”

How life insurance and mortgage insurance compare:

While mortgage life insurance can be convenient (given that premiums can be built into monthly mortgage payments and applicants only need to answer a few questions to be “approved”), it has significant limitations that could leave your loved ones no better off. In fact, many industry experts have expressed skepticism about the efficacy of this type of insurance, with Rob Carrick of the Globe and Mail warning consumers to avoid it under most circumstances.

Choosing your life insurance protection

Life insurance offers the guarantees needed for today while remaining flexible to adapt as needs change. Life insurance policies can provide you options, including allowing you to change your coverage as your financial needs evolve. Some policies may also allow you to suspend payments if you become disabled and cannot work. With so many options available, there is a life insurance solution available to suit your financial needs and priorities.

A licensed insurance advisor can answer your questions and help you decide if life insurance is the right option for you to protect your mortgage and your family. These professionals can also help you explore alternatives (e.g. disability insurance, critical illness insurance) to create a more comprehensive and robust protection plan.

The information contained in this article is of a general nature only and should not be considered personal insurance or financial advice. For specific advice about your situation, please consult with your financial advisor.